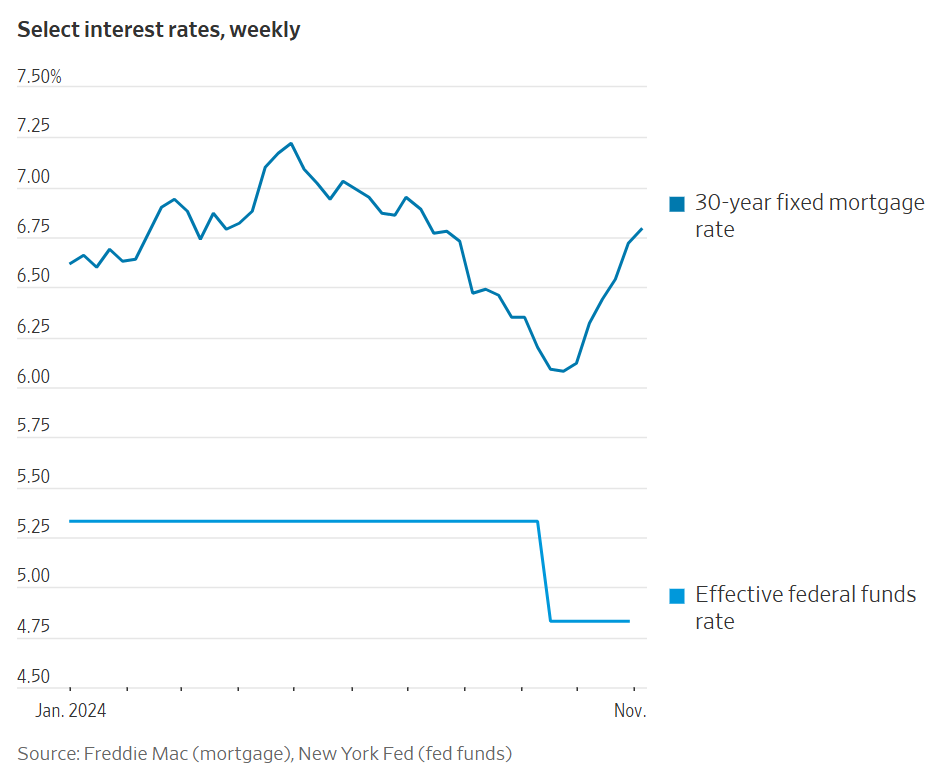

When you hear “The Fed cut rates,” it might sound like mortgage rates should drop too. But it’s not that simple! The Federal Reserve recently lowered the Federal Funds Rate by a quarter point, from 4.75-5.00% to 4.5-4.75%. Oddly enough, since the Fed began cutting rates in October, the average 30-year mortgage rate has actually gone up by nearly half a percentage point.

What Effects Mortgage Rates?

The Fed isn’t directly lowering mortgage rates. They’re cutting the Federal Funds Rate, which is the rate banks use to borrow money from each other overnight. When the Fed Funds Rate is lowered, the cost of banks borrowing money is cheaper. The goal is for banks to pass those savings onto us, the consumer. When the Federal Funds Rate drops, interest on credit cards, car loans, and home equity lines of credit usually goes down too. But mortgage rates work a little differently.

The 10-year Treasury Yield

Mortgage rates follow the 10-Year Treasury Yield, not the Federal Funds Rate. For further info on why that is you can read about it here. Since October, the 10-year yield has been going up. Think of the 10-year yield like a weather forecast for the economy. If investors expect strong job growth, more government spending, and higher inflation, the 10-year yield goes up. But if jobs and inflation numbers come in lower than expected, the 10-year yield drops too.

How Does The Election Effect Mortgage Rates?

The election can impact mortgage rates too. After Trump’s re-election, many investors expect tax cuts and increased government spending. Trump has also proposed tariffs, or increased costs for other countries to ship goods to the US. All of this often leads to a higher deficit and higher inflation, which leads to higher mortgage rates.

What’s Next?

Did mortgage rates go up today? Will they go up tomorrow? If economic signals continue to point towards economic growth, higher government spending (aka lower taxes), higher costs on imported goods, we can assume that rates will stay higher for longer. If the labor market starts to weaken (less jobs added each month and more unemployment claims) and the CPI (measure of inflation) trends lower, then the 10 yr will go down as well.

What Can I do to Lower My Mortgage Rate?

If you’re looking to buy a home, there are ways to get a lower mortgage rate. Here are a few ideas:

- Raise Your Credit Score: A higher credit score usually means a lower mortgage rate.

- Consider Different Loan Types: Loans like a 10/1 ARM or a 7/1 ARM often have lower rates than a 30-year fixed mortgage. For example, Erin and I have a 7/1 ARM, which has saved us money every month!

- Look into a Buy-Down Option: A 3/2/1 buy-down lets you pay some money upfront at closing to reduce your mortgage rate for the first few years of your loan. You can even ask the seller to cover this for you!