It’s the most wonderful time of the year – when banks, publications and trade groups alike try their hand at mission impossible: telling all of us what 2025 holds for the residential real estate market. After 15 years as a real estate agent in NYC I have come to a simple and cynical conclusion: it’s a waste of time.

Nassim Taleb in his book “The Black Swan” says that we, as humans, just aren’t capable of making forecasts. Our brains weren’t built for it. “Our minds are wonderful explanation machines, capable of making sense out of almost anything, capable of mounting explanations for all manner of phenomena, and generally incapable of accepting the idea of unpredictability…what is surprising is not the magnitude of our forecast errors, but our absence of awareness of it.”

I certainly count myself as one of the forecast-challenged. Yours truly vividly remembers sitting in my office in February of 2020 telling a client on the phone that we’d all take a month off in March and then Covid would be over and done with. Wishful thinking, or as Taleb would put it, an inability to accept the idea of the unpredictable.

That being said, I don’t think ignoring forecasts outright is productive. I am suggesting that we review them and then have a healthy disregard for them. Here I will provide a extremely brief overview of national market forecasts, and then the steps you can take that will enable you to navigate the 2025 real estate market regardless of what actually comes to pass. TLDR: in 2025, more homes will be sold than were sold this year, prices will continue to rise, there will be an uptick in inventory, and mortgage rates will either go up a bit or down a bit. Pretty groundbreaking stuff, huh?

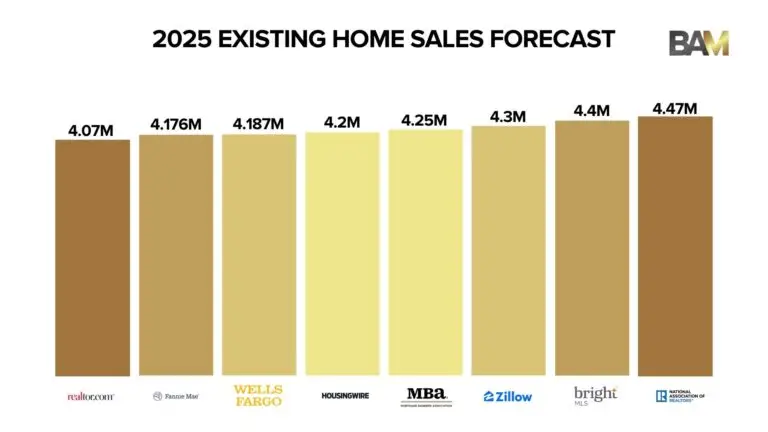

Existing Home Sales Prediction for 2025:

So far, experts predict we will come in just shy of four million homes sold in the U.S this year. Below are forecasts for next year, ranging from a very small uptick to an over 10% increase in the number of sales.

Home Price Growth Prediction for 2025

Nationally, we are seeing about a 4.5% appreciation rate for homes in 2024. Below are the forecasts for price growth next year.

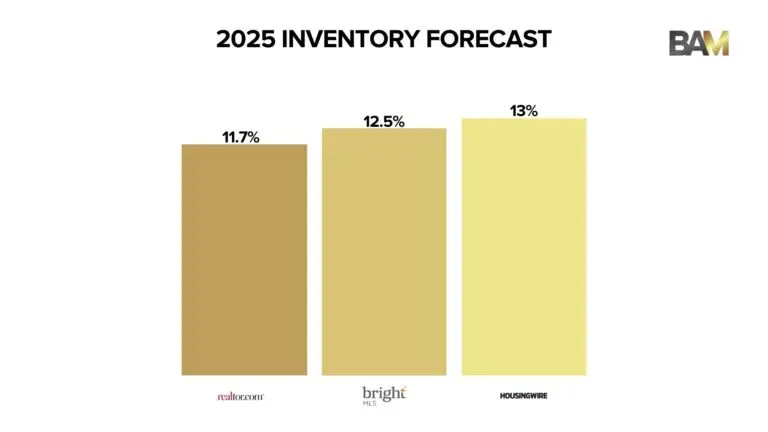

Inventory Predictions for 2025

If recent history is any guide, inventory will be heavily influenced by mortgage rates (hang on, rate forecasts are next).

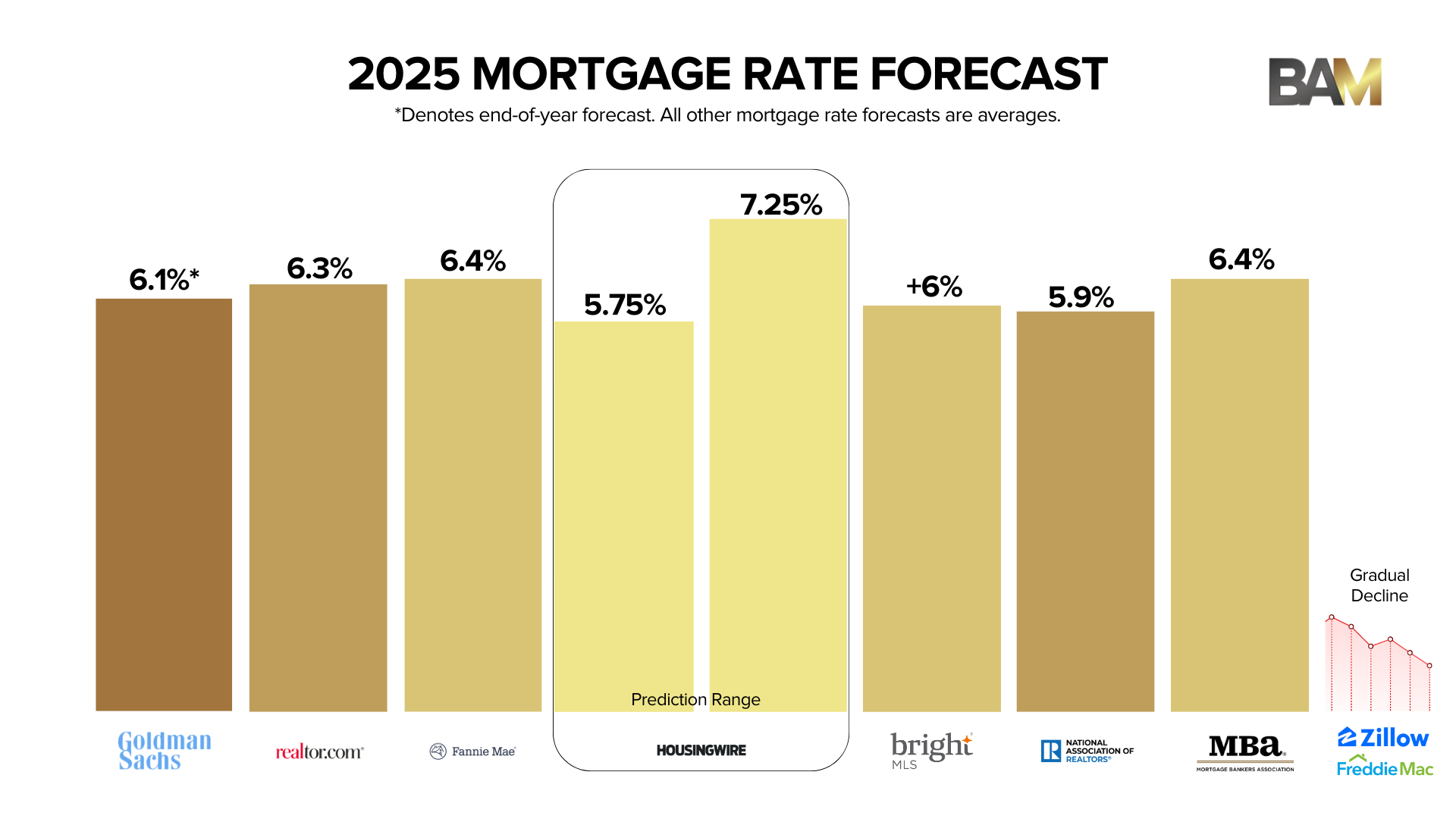

Mortgage Rate Forecasts for 2025

The average forecast here comes out to be about 6.25%. As of this writing, the national average on a 30 yr jumbo is 6.75%. Most of NYC mortgages are jumbo, but not because we simply can’t help being extra. All loan amounts over $1.149M are jumbo. Isn’t jumbo such a great way to refer to a sizable amount of debt? Pretty sure a marketer or banker didn’t come up with that one.

What to do with this information

Ok so what are we to do with all this, and how do we responsibly throw all of it out of the window? I have two suggestions:

First, run numbers as if mortgage rates got to be as high as 7.25-7.5%. This is the highest of all of the rate forecasts and is certainly a way to welcome the idea of the unpredictable with open arms. To my 2025 Buyer or Seller, consider this: A household making $450,000 can afford a $2M home if the rate is 6.25%. If the rate ticks up to 7.5%, that goes down to $1.84M. It’s an 8% drop in that household’s affordability. That’s significant, and I’d wager a 7.5% mortgage rate would have an even bigger effect on consumer psychology market wide. But hey, we’ve all been through rates that high and lived to tell the tale. IF it happens, the NYC market can weather it. I should point out this is the residential market. The commercial market is not nearly as resilient on this front. But I digress…

Next and perhaps most important, take the focus off the forecasts and put it on yourself. Here are the two questions that I make sure all of my clients ask themselves before embarking on a real estate transaction: 1) Will there be a quality of life improvement for you and your family on the other side of this transaction? And 2) Will this transaction help to either build and/or protect your wealth? If the answer to one or more of these questions is a no, then I would suggest that you sit tight. Otherwise, take that next step (which would be contacting me).

These two questions apply regardless of who the president is, what the economy is doing, and what some group of analysts with unlimited money and data think will happen next. And when they are wrong, which they will be, or they adjust their forecast, which they will, you’ll be good. No matter what. Happy New Year!